The first chapter in Oakville’s 2023 property tax story is out in draft form.

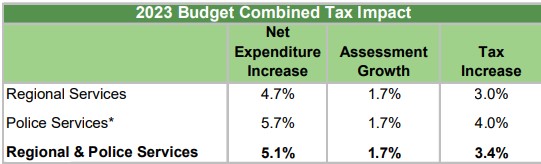

In documents released publicly on Dec. 14, Halton Region is proposing a $1.1 billion operating budget that will hike property taxes by 3.4 per cent next year.

That would see the owner of a property assessed at $1 million pay about $93 more next year for regional taxes.

Regional taxes pay for police, paramedics, waste management, social services, public health, public housing and regional roads.

The total Oakville property tax bill will combine regional, town and education taxes. Details on the town and education portion won’t arrive until next month.

Members of the public and regional politicians still have a chance to weigh in on the proposed Halton budget at meetings scheduled for Jan. 18 and 25.

Policing costs continue to climb

The total operating budget for the region is $1.1 billion, which includes $186 million in proposed spending by Halton police.

The 2023 police budget is up 5.7 per cent from the 2022 budget.

In a report to the Halton Police Board, Chief Stephen Tanner says the increase is needed to fund 20 new officers and 5 new civilian positions in response to “emerging trends and continued growth in demand for policing services.”

He also points to upcoming contract negotiations, inflationary increases to fuel and construction costs and enhanced cybersecurity investments.

"I believe it a responsible budget that will allow the service to provide the service Halton residents expect," said Ward 5 councillor Jeff Knoll, who chairs the police board.

The board still needs to formally approve the 2023 budget at its meeting on Dec. 22.

Water and wastewater rates on the rise

Along with higher tax bills, expect to see your water and wastewater costs jump by 4.1 per cent in 2023.

That will cost an extra $42 for a typical home using 226 cubic metres of water annually.

Water and wastewater services are not funded through property taxes but rather through usage charges. Water billing is done through electricity bills.

The hike includes a 1.7% increase for operational expenses and a 2.4% increase driven by capital financing required to support capital expenses.

Uncertain times for budgeting

Volatile inflation and changing provincial rules are combining to create budget uncertainty.

The budget documents from Halton regional staff note that “significant cost pressures driven by the increased cost of goods, services and construction due to high inflation” has impacted this year's financial outlook. While the 2023 budget includes an inflationary assumption of 3 per cent, actual inflation has been much higher for most of the year, with the consumer price index hitting 6.9 percent in October.

Expected changes to the provincial funding of other programs are adding to the uncertainty. And while Bill 23, the province’s recently approved housing legislation, will significantly change regional responsibilities and revenues, many details remain unclear. That impact has not been included in the 2023 budget.

Town in "very good position financially"

With the launch of a new term of council following October’s municipal election, the town won’t begin its budget process until January.

Ward 6 councillor Tom Adams, who has chaired the town's budget committee since 2009, says the proposed regional budget positions the town to keep its overall property tax increase in line with inflation.

But he warns that the town faces similar budget uncertainties for the coming year, including high and volatile inflation driving up the cost of salaries and benefits, fuel and materials and particularly construction.

“If you are in the commercial or industrial construction world – and municipalities are because we’re competing for projects that are major facilities and major transportation infrastructure projects – those projects have seen very significant inflationary impacts.”

Read more: What will inflation do to your property taxes?

He adds that the town is also facing some “pretty dramatic changes” from the province.

"The financial risks associated with the provincial changes that reduce municipal funding from development for the related infrastructure are real and substantial," he said. "We continue to wait to see if the province will carry through in making municipalities whole for these costs."

But he offers reassuring words for anxious taxpayers.

“Oakville is in a very good position financially, and we have been for a number of years,” he said, pointing to a strong stabilization reserve fund available to help manage unexpected costs

“The town will continue working toward keeping its property taxes overall in line with inflation,” he said. “Between the town, the region and education taxes, we try to provide a stable, predictable tax environment for both residents and businesses.”

Budget committee meetings will start on Jan. 17 and run through February. Sitting on this year’s committee: Mayor Rob Burton and councillors Adams, Allan Elgar, Janet Haslett-Theall and Sean O’Meara.