Oakville Chamber delivers member priorities to Minister of Finance Rod Phillips, MPP Stephen Crawford and MPP Triantafilopoulos during Budget Consultation.

Thank you for the opportunity for us to provide the Oakville Chamber recommendations for the upcoming Provincial budget 2020.

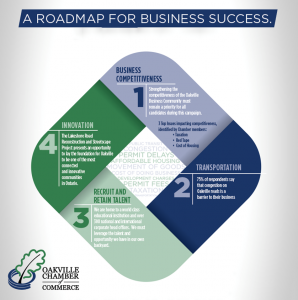

In our most recent advocacy surveys, members identified business competitiveness, transportation, recruiting and retaining talent and innovation as their top priorities.

We commend the government on its intention to form a Premier’s Advisory Council on Competitiveness to identify opportunities for improving Ontario’s competitiveness.

Our members identified taxes as an obstacle to business competitiveness and growth. To that end, recognizing that the government has already announced a reduction in the small business Corporate Income Tax rate, there is still more that can be done to encourage business growth and scale up with regard to the structure rather than the level of the Corporate Income Tax.

The Small Business Deduction (SBD) reduces the Corporate Income Tax (CIT) rate on companies’ first $500,000 of active business income. The flat rate structure of the Small Business Deduction means that companies are faced with a substantial rise in their corporate tax rate when their annual income increases above $500,000 at which point the rate jumps from 3.2 percent to 11.5 percent. To address this challenge, the Chamber network recommends creating a variable or bracketed Small Business Deduction for income below $500,000.

With a Corporate Income Tax rate that increases gradually as revenue grows, small business owners would no longer be discouraged from actively seeking opportunities to grow their firms. This reform should be revenue-neutral, such that total tax revenue generated before and after the change remains the same.

Additionally, we encourage the Province to exempt businesses’ incremental income (additional earnings over the previous year) from the Corporate Income Tax in a given year. With this exemption in place, firms that are growing can reinvest more into their businesses. Eligibility could be restricted to target higher-growth firms by setting a threshold minimum rate of income growth over the previous year to qualify for the exemption.

Transportation infrastructure and congestion remains a top concern for the Oakville community. Congestion on Oakville roads is a barrier to business, and members cite that Oakville does not have the road infrastructure for the development it needs. Additionally, Oakville’s economic growth is an important factor in the success of the Greater Toronto Hamilton Area (GTHA).

According to the Provincial Ministry of Finance, the Greater Toronto Areas (GTA) population is projected to increase from 6.9 million in 2017 to 9.7 million in 2041. Halton is projected to be the fastest-growing census division in Ontario over the projection period, with growth of 56.2 per cent to 2041.

Increased employment growth, as well as population growth, is positive for our local economy; however it also underlines the Chamber’s call for building a resilient transportation network that works for all modes of transportation to supply the movement of goods and people.

Recognizing that the province has committed to a share of funding for local projects like the Wyecroft Bridge, the Burloak Underpass and the Kerr Street Underpass, with the projected population growth mandated by the provincial growth plans, Oakville would benefit from a sustainable and planned funding program by the Province for infrastructure projects such as the network required for MidTown which was identified as an Urban Growth Centre.

A reliable transportation network is essential for trade, the movement of goods and services as well as people. It is also integral to our province’s economic competitiveness.

As our communities become more connected through the collection of data, artificial intelligence and technology, it is vital that we are prepared for the business climate of the future and that we remain competitive with other jurisdictions.

Population growth as well as increased employment growth, is positive for our local economy; however, it also underlines the need for building a resilient transportation network that works for all modes of transportation to supply the movement of goods and people.

A report recently released by the Province signals that the province is positioning Ontario to be a leader in the development, commercialization and adoption of advanced manufacturing and mobility technologies. Supporting new mobility technologies, enhancing the innovation ecosystem as well as supporting research and development and early stage technology development are all measures that will assist communities in their efforts to adopt new technologies.

Beyond providing the legislative and regulatory framework, the province can further connect municipalities and establish a common framework for the development of alternative Connected Vehicle/Autonomous Vehicle scenarios, readiness guidelines, and potential projects. The creation of a dedicated program could further incent municipalities to invest in infrastructure/technological updates within their local jurisdictions; thereby creating a healthy environment for emerging transportation technologies.

The future efficient movement of both people and goods and services will depend on the effective management of a connected infrastructure.

As the industry evolves and becomes a reality, it will become a competitive economic advantage for communities that embrace it—and a disadvantage for those that don't.

The new market for automated and connected vehicles is expected to grow exponentially and large economic benefits are expected. Other regions are not standing still (e.g. United States, Japan and China) are already adopting strategies for automated vehicles and attracting investment in this field. Companies could soon be including Autonomous Vehicle, connectivity and technology readiness in their decisions on where to locate a business or expand operations.

Chamber members have also identified recruiting and retaining talent as a barrier to their ability to succeed. We believe that strong partnerships between government, industry, and post secondary institutions are fundamental to supporting a robust and dynamic workforce. Experiential learning programs – including but not limited to work-integrated learning, co-operative education, and internships – are one of the ways these partnerships help ensure students are graduating with the skills in demand by today’s employers and the jobs of tomorrow.

To that end, we encourage the government to explore options to incentivize greater employer participation in these programs. For instance, this might involve expanding the Co-operative Education Tax Credit or offering a tax credit to employers who hire graduates of co-operative education.

On behalf of the Oakville Chamber, I thank you for the opportunity to share our member’s priorities for the upcoming budget.

Read more articles by Faye Lyons the Vice President, Government Relations & Advocacy for the Oakville Chamber of Commerce in OakvilleNews.Org. You can also follow the Oakville Chamber on twitter @OakvilleChamber.