The Ontario Government has announced their intention to implement a new “Green Commercial Vehicles Program” that intends to offer rebates to qualifying Ontario businesses, if they invest in specific “green” technologies for their commercial vehicles.

The objective of the program is to reduce greenhouse gas (GHG) emissions resulting from Ontario registered commercial vehicles. The government states that in 2015, 31% of Ontario greenhouse emissions resulted from the road based movement of freight. Both the news release and the related “Program Guide” offer no guidance on the expected cost of this proposed program and resulting reduction in GHG emissions.

A Program Guide for consultation has been issued that sets out the details of the program including eligibility, rebate amounts, and the application process. The government is seeking public review and comment until October 6, 2017.

If you are a business registered in Ontario with a valid Business Registration Number, corporate number or CRA number and make certain “green” modifications to your owned or leased commercial vehicle and meet a specific Commercial Vehicle Operator Registration (CVOR) safety rating and agree to participate in data collection – then you might qualify for rebates.

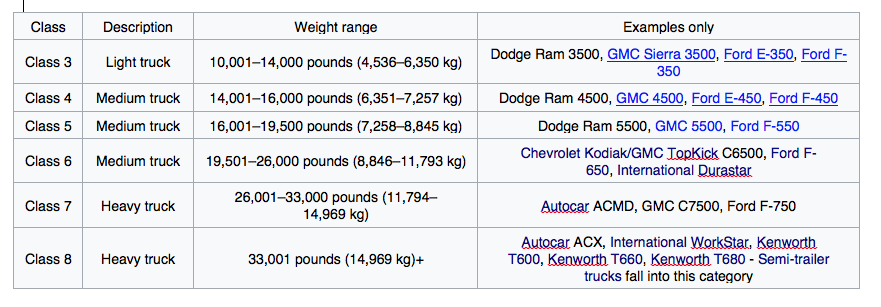

For certain new commercially available Battery Electric or Plug-in Hybrid Electric Vehicles (Class 3-5: 4,537-8,845 kg) the rebate is 50% of the incremental cost (up to a cap of $75,000). Electric retrofits or conversions are not eligible.

For vehicles completely powered by natural gas (including compressed, liquefied or renewable natural gas), the rebate is worth 30% of specified incremental costs up to a cap of $30,000. For qualifying natural gas conversion vehicles (Class 6-8 with GVWR of 8,846 kg or greater), a rebate of up to $30,000 is also available.

Finally, there are also smaller rebates available for dual-fuel (natural gas/diesel) vehicle conversion as well as investing in a number of technologies that are shown to have improved fuel economy and reduced emissions such as trailer skirts and boat tails and certain anti-idling technologies.

For more automotive reviews and insights, follow me on Twitter @redy2rol.